Radiopharm Theranostics (ASX:RAD,OTC:RDPTF, ‘Radiopharm’ or the ‘Company’), a clinical-stage biopharmaceutical company focused on developing innovative oncology radiopharmaceuticals for areas of high unmet medical need, is pleased to announce the appointment of Dr Oliver Sartor, MD to the Company’s Scientific Advisory Board (SAB). Dr Sartor is an internationally recognised medical oncologist and scientist specialising in prostate cancer and radiopharmaceutical therapies. He ...

Orange juice prices could rise by 20% to 25%, according to Johanna Foods, a small U.S. business suing the White House over tariffs threatened against Brazil. President Donald Trump said in a July 9 letter to President Luiz Inacio Lula da Silva that he would apply a 50% tariff to all imports from Brazil starting Aug. 1. Trump said the ...

Stallion Uranium Corp. (the ‘ Company ‘ or ‘ Stallion ‘) ( TSX-V: STUD ; OTCQB: STLNF ; FSE: FE0 ) is pleased to announce the results from a Stepwise Moving Loop, Time Domain Electromagnetic (‘ SWML-TDEM ‘) survey completed over the high-priority Coyote Target on its Moonlite Project (Figure 1). The Coyote Target, located within the Southwestern Athabasca ...

Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQX: SYHBF ) (Frankfurt: SC1P ) ( ‘ Skyharbour ‘ or the ‘ Company ‘) is pleased to report that its partner company Terra Clean Energy Corp. (‘Terra’, previously Tisdale Clean Energy) announces results from its Winter 2025 drill program and provides an update on the upcoming summer drill program at the South ...

Heliostar Metals (TSX.V: HSTR, OTCQX: HSTXF, FRA: RGG1) (‘ Heliostar ‘ or the ‘ Company ‘) is pleased to announce that it is participating in the Metals & Mining Virtual Investor Conference hosted by VirtualInvestorConferences.com on July 24, 2025. Vice President Investor Relations & Development Stephen Soock will present live to share how the Company’s combination of immediate cash flow, meaningful ...

(TheNewswire) Vancouver, BC TheNewswire – July 21, 2025 – Element79 Gold Corp. (CSE: ELEM,OTC:ELMGF | FSE: 7YS0 | OTCQB: ELMGF) (‘Element79 Gold’ or the ‘Company’) is pleased to announce the appointment of Michael Smith as Vice President, Corporate Development, engaged under contract to support the Company’s renewed growth trajectory and strategic ...

Here’s a quick recap of the crypto landscape for Monday (July 21) as of 9:00 a.m. UTC. Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news. Bitcoin and Ethereum price update Bitcoin (BTC) was priced at US$118,841, trading flat in the last 24 hours. The day’s range for the cryptocurrency brought ...

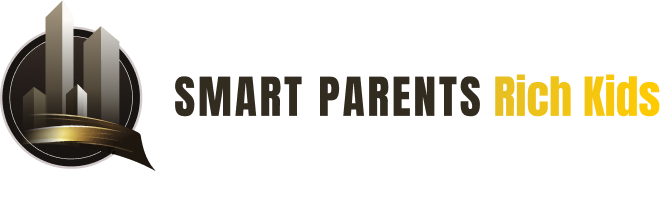

The Nifty traded in a broadly sideways and range-bound manner throughout the previous week and ended the week with a modest decline. The Index oscillated within a narrow 276-point range, between 25144.60 on the higher end and 24918.65 on the lower end, before settling mildly lower. The India VIX declined by 3.60% over the week to 11.39, suggesting continued complacency ...

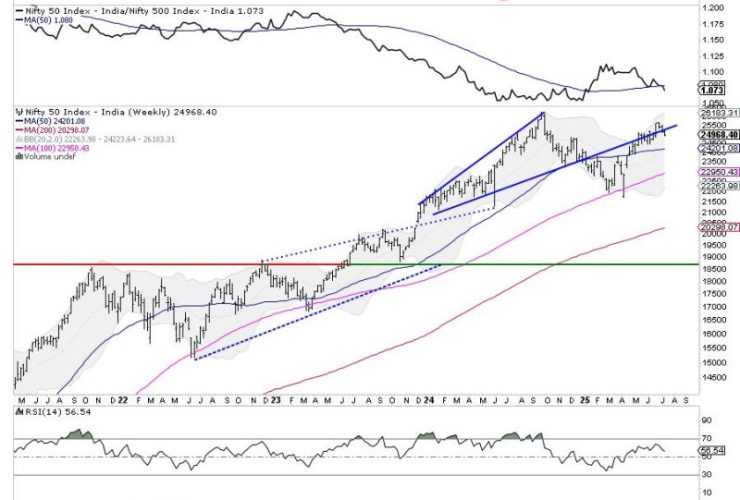

Sector Rotation Stalls, Tech Remains King Despite a slight rise in the S&P 500 over the past week, the sector rotation landscape is presenting an intriguing picture. For the first time in recent memory, we’re seeing absolutely no changes in the composition of the sector ranking — not just in the top five, but across the board. Will this stability ...

Investors honed in on tech stocks again as Q2 earnings season kicked off on Monday (July 14). Some experts believe the rallying market is showing signs of frothiness. Apollo Global Management (NYSE:APO) Chief Economist Torsten Sløk highlighted concerns about overvaluation mid-week, comparing the current tech craze to the dotcom bubble of the 1990s. “The difference between the IT bubble in ...